Addison:

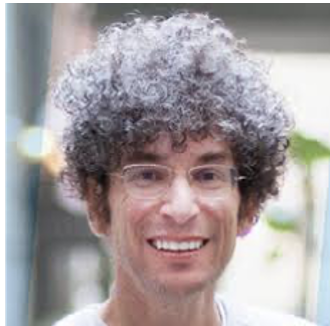

Welcome to The Wiggin Sessions. I'm Addison Wiggin, I'm your host. I have with me, my

good friend, James

Altucher. We've spoken many times, but today we're going to focus in on some of James's

recent thoughts on

cryptocurrencies. And I want to focus, at the moment of this recording, Russia has just

invaded Ukraine. I

want

to talk about cryptocurrencies in the context of a wartime economy.

Let's start about things that we do know about, economic ramifications. I was just

writing this morning

about

a piece that Bill Bonner wrote that said we're looking at $7 gas, which is going to have a

drag on the US

economy. And then there are supply chain issues already. And when people start re-gearing

their factories or

whatever for war, that further drags on the supply chain. So there are going to be

implications. I mean, it

depends on how long the conflict lasts, but we should be prepared for things that are going

to ripple out

from a

war in central Europe. I mean, that's a big deal.

James:

It is a big deal. And look, people are saying, "Oh, this is the worst thing. That's the worst

geopolitical crisis

since World War II." That's clearly not true. I mean, we've had the Balkans, we've had obviously the

Vietnam War,

the Korean War, two wars in Iraq, a war in Afghanistan, so. But yeah, this is pretty big. Also I

will note, we've

been at war with the Middle East for practically forever or parts of the Middle East.

Addison:

Yeah.

James:

And the price of oil is still lower right now than it was in 2005 or 2006, for instance, it went

up to $150 a

barrel.

The US has been on and off a net exporter of oil and gas. And there's other discoveries of oil

now happening in

the

North Sea, near the UK. There's a lot of oil. Given that we have new technology for finding oil,

this 3D seismic

technology and new ways of drilling for oil, I'm not that worried about the price of oil.

There's plenty.

Let's say the world reached peak oil in the 1980s, but now it's no longer at peak oil because of

new technologies

that have discovered oil. And of course we have more oil efficient cars and so on. So I'm not

that worried about

it.

Although of course oil is up because of the panic and the uncertainty, that of course leading

oil up. So I'm not

quite sure I buy into how this is going to have more effect on the price of oil than going to

war with Iraq or

Iran

or other parts of the Middle East having chaos. That would have more effect on the price of oil

and it didn't

really

have that much effect.

So I think really more the issue here is, and this is just a political thing and we want to talk

about the

economy,

but we have to look at who promised who, what. So we don't want to get into an accidental war

because let's say,

I'm

just going to make this up, let's say Poland promised Ukraine they would help them, France

promised Poland, we

promised France, and then in a domino effect, we all get into a war. That's sort of like how

World War I

erupted.

Addison:

Yeah.

James:

And it doesn't look like that's happening because our first response and second and third

response has not been

military, but has been financial. So now we're talking about removing, not only have we put on

very hard

sanctions

on Russia at this point, but now there's a lot of talk about taking Russia off the International

SWIFT System,

which

is the way of messaging bank wires. So if I want to wire money to Russia, or someone wants to

wire money from

Russia

to me, the wire transfer is confirmed using the SWIFT systems, the international messaging

system for bank

wires.

And that would have a significant impact on Russia and dollars in Russia itself has been trying

to build their

own

backup plan just in case they're removed from the SWIFT System. But of course what's the

ultimate backup plan

that

already exists and already works is Bitcoin and Crypto. You can transfer as much money as you

want without using

any

system just transferring cryptocurrencies through these digital wallets. So right now, the day

the Ukraine was

invaded, Crypto fell like 10 or 11%. But now, Bitcoin is higher than it was the moment Russia

invaded. It

quickly

bounced back because I think in general, and by the way, this is going to be related to what's

happening in

Canada

as well. I think political uncertainty and crisis have two stages.

There's the chaos stage where we have no idea what's going to happen. It's just crazy.

Everything. We don't know

what's going on. We don't know how it's going to end. It's just uncertain. So Ukraine has been

like that for a

few

weeks where clearly something was going to happen, but we didn't know what and we were scared.

Were we scared

because we didn't want Ukraine to be invaded? That was a little part of it. But I think we were

just scared

because

nobody knew how markets would react. So when you don't know how markets are going to react, the

first instinct

is to

pull your money out of all the markets. So what we saw was the stock markets all went down. Like

every stock

went

down, Crypto went down. Just everybody was going to cash. And by the way, gold went up. But

since then, Crypto

has

gone up more than gold.

Addison:

Yeah, I was writing about that. Gold went up. It was a typical "buy the rumor, sell the news"

action. Leading

up to the invasion, gold was going up pretty substantially. And then as soon as the invasion

began, it dropped

lower than the starting point. It went up 40 bucks and then it went down 60 bucks. Within a 12

hour

period.

James:

This really is a generational thing. For an older generation, gold is a flight to safety. For a

younger

generation

now, and ongoing, perhaps, Bitcoin is a flight to safety. So at first, Bitcoin was being swept

up in the

uncertainty. It was going down. But now, we're getting more and more certain about what's

happening. Doesn't

look

like military involvement from the US.

If anything, what's happening in the Ukraine and the effects on the stock market is almost

serving as a rate

hike, so

this might even alleviate concerns the Fed is going to hike rates too quickly. Again, we have to

look at the

fundamentals. Okay, if countries are going to be thrown off the international wiring system,

like Russia might

be,

crypto is a potential backup plan, or crypto's infrastructure is a potential backup plan.

So whether Russia uses it or not, I'm pretty sure crypto influencers or countries that are

interested in crypto

are

definitely viewing what's happening and saying, "Hmm, maybe crypto should be my backup plan as

well." So

similarly

in Canada, we have this outrageous situation. I'm sure a lot of people are looking at Russia or

Ukraine, and

saying,

this is outrageous and correctly so. It is outrageous. But for me, it's almost inconceivable

that Canada of all

countries would essentially declare martial law against its own citizens.

I personally know people who have had all their bank assets frozen, their credit cards canceled

by the Canadian

government because the Canadian government declared Martial law. These people had donated some

money to the

trucker

protests. That begs the question, what is Canada even thinking? This Emergency Powers Act that

Canada passed in

1988

says that if there's a threat of serious violence, the prime minister could declare emergency

powers for a

30-day

period. There was no threat of serious violence. These protests have been peaceful as far as I

could tell.

I'm not an expert on them, but they seem to be peaceful. Then he invoked a similar law allowing

him to seize all

their money. This is like the slippery slope that every authoritarian government in the world

starts to take,

and

now we're seeing it in Canada. So what's the first thing people think? Well, if you own

cryptocurrencies and

they're

stored outside of Canada, if your wallet or whatever is in hard storage or if you're on a

decentralized finance

exchange as opposed to a centralized exchange, you can't have your assets frozen.

So a way to protect yourself, if you're even a peaceful protestor in a peaceful country, you have

to start

thinking

of crypto, because Canada, as far as I know, is the most peaceful country and these are the most

peaceful

protests

and the most peaceful people. Right? It's almost a joke.

Addison:

Oh, sorry.

James:

Yeah, right.

Addison:

Sorry we're protesting.

James:

So I don't know what they're even thinking, but in the long run, or even in the short run, this

should be a very

good

thing for the price of crypto. It's a very bad thing for the people involved, but it's a very

good thing for the

price of crypto because all these situations are underlining the reasons why money itself had to

evolve into

crypto.

The world is very global. We interact with other countries. There's lots of reasons why we need

an international

currency where you're not affected by any one central bank, you're not affected by any one

government, the risk

of

forgery is lower, it's easier to transfer money around without six middlemen taking fees.

If I transfer money to you and you're in Korea, say, I've got to transfer through my bank, my

local reserve bank,

the

federal reserve bank, the Swift system, and then all the way down to you in Korea, whatever

banks have to go

through

in Korea. There's human error every step of the way, there's fees every step of the way, and

that's the

inflation of

the financial system.

So even in a normal society, crypto avoids all those. But now we have this extra risk, which is

that Canada might

seize our money. It's ridiculous. It's almost a joke when you say the words. Of course, Russia

as a country

might

need, again, an alternative to the centralized wiring system between international banks.

Addison:

So let me ask you a question. Crypto has been more like a fad, trading fad, like people are

trading charts

and stuff like that up to this point. But then when we entered into the pandemic where

restaurants were getting

shut down and you couldn't move around freely, you couldn't even travel to other countries at

certain points,

people started using Zoom technology and communicating the way we're communicating right now.

Then we have these

weird, political things going on, Canada and Ukraine. It's almost like the solution was

predetermined. But prior

to that, it was looked at more like a speculative investment than an alternative to the monetary

system.

James:

Yeah. Look, in 1999 through 2001, I ran a VC fund focusing on the internet. I remember in mid 2001,

the internet had

"busted." All the internet stocks had gone away or were trading for nothing. I had this defender

arcade machine,

this 1980s defender arcade machine in my office.

Addison:

I have one now.

James:

Oh really?

Addison:

Yes.

James:

Yeah. But anyway, I had this in my office and my partner was playing. We were all frustrated

because all our

investments were down, and then he lost the game and he hit the screen, smashed it, and then he

said, "This

effing

internet thing is just a fad." He walked out and quit. I never saw him again because he thought

it was just the

whole internet, he gave up his career on Wall Street to be an internet VC fund and he said,

"This internet

thing's a

fad."

People still thought it even then. It was 10 years after the web developed and 30 years after the

internet was

developed, so it takes a while. It took a while for people to enter credit cards into e-commerce

sites because

they

were worried, and I get it. It takes a while for our human psychology to accept a new, even life

changing system

like that. So are we still going through that with crypto? A little bit, but let's compare.

You and I started talking about crypto in mid 2017, and we thought of it then as a great idea

because it's this

evolution from money. But there weren't a lot of users, and that was a big problem. So it really

did feel a

little

more speculative. You couldn't tell. But now look at 2021. I don't know the exact numbers, but

let's say $10

billion

worth of transactions on the Ethereum network between NFTs being sold, DeFi exchanges exchanging

cryptos and

other

assets. There's hundreds of millions of dollars of transactions a day now, and this is only

getting bigger.

So 2021 was a good year to see real usage on Ethereum and Bitcoin powered networks and other

powered networks

like on

Binance. Now in 2022, what I expect we'll start seeing is not just dollar transactions

happening, like huge

numbers

of transactions and users using it, but I expect to see real world use cases. So I don't want to

just go on an

NFT

marketplace and buy a JPEG. That to me is not a real world use. But I've even talked to sports

teams' owners

about

this. I said, "When are you going to use NFTs as tickets?" So I'll explain what that is.. If the

New York Knicks

sell me a ticket for $100, the New York Knicks makes that $100. If I then sell that ticket to a

scalper for $200

and

the scalper then sells that ticket for $500, the Knicks makes no money. The New York Knicks only

made the money

on

the first transaction. But if you make every ticket an NFT, the Knicks would get a royalty on

every secondary

sale.

By the way, anyone who makes the Ticketmaster NFT, knock yourself out. A company that does this,

it's going to

be a

multi-billion dollar company, whoever does it. Steal the idea for me, go knock yourself out. But

there's going

to be

lots of real world use cases like that.

Or imagine DeFi exchanges where McDonald's stock is traded. Instead of there being all sorts of

middle men on the

New

York stock exchange and all sorts of fees and so on, I expect these DeFi exchanges to start

trading stocks. Or

even

the US Central Bank, the Federal Reserve, is talking about making a digital or a crypto version

of the dollar.

So

when every country has their own crypto version, we're going to need a crypto exchange as the

Forex, as the

currency

exchange of all these crypto stable coins. That's probably going to be powered by Ethereum or

something similar

to

Ethereum.

Once we start seeing that, the sky's the limit. We could predict prices, but it's just going to

be ongoing, more

and

more uses of crypto. The financial world will get bigger because there's going to be more asset

classes than

ever

before. You could IPO, for instance, part of your house. Ten percent of your house, you could

say, "Oh, I'm

going to

turn it into a token and have a trade on an exchange," and it'll be valued what people estimate

10% of the value

of

your house is at this point. They could bet if it's going to go up or down.

So there's suddenly going to be brand new asset classes, hundreds of billions of dollars of

entrepreneurial

opportunities, which is why you're seeing so many VC funds raising money now. They weren't

raising them in 2018.

They're raising the money now because now is when the real world use cases will start. If they

don't start, then

I

would agree that crypto is still speculative, but I'm seeing the beginnings of it this year,

that real world use

cases will happen.

Addison:

Let's go back to Fedcoin. That's something that has come up in our writing. People are

writing in, "Do you

see the Fed creating their own coin and then outlawing other coins?" That's the theme of the

reader mail that we

get. The idea is that they're going to use blockchain technology to digitize the dollar, the

dollar would still

remain the reserve currency of the world, and then they would use that as an impetus to outlaw

other Bitcoin or

other even platforms that cryptocurrencies are traded on.

James:

Yeah. I think it's really interesting because a lot of people get very agitated one way or the

other about the

possibility of the Fed making a crypto version of the dollar. For me, it's actually an exciting

thing in that I

think it'll make some decentralized finance exchanges that are built on top of crypto. It'll

make some of them

very

huge because they'll start trading in the currencies of all these stable coins.

There's one coin right now, which actually I'll give it away. We recommend it in our portfolio,

it's called Terra

LUNA. They basically allow for very fast, international e-commerce. So I could buy something in

Japan and the

transaction happens instantly because the yen would get converted into a digital yen, which will

then get

converted

into Terra LUNA which will then get converted into a digital dollar, and all the transactions

happen instantly

at

very low fees. You're not going through all these wiring systems.

So what is that? But it's in effect, it's basically a currency exchange. It's intended to help

with e-commerce,

but

in reality, it's a currency exchange. So I think that's the positives. They're definitely not

going to outlaw

any

other cryptos because they need the crypto ecosystem to keep working if they're going to have a

crypto-based

dollar.

Now, they could be nervous about crypto, but if they want to keep being the reserve currency of

the world, they

have

to compete favorably with all the other cryptocurrencies that are out there.

Countries are accepting Bitcoin as legal tender, like El Salvador, and there's going to be more

countries. So the

US

is not going to go the way of China and Russia and say, "Hey, we're thinking of banning crypto,"

because they're

not

going to go the way of the most authoritarian countries in the world. They're going to hopefully

do the

opposite.

They'll do what Bill Clinton did in 1995 where a lot of people wanted to outlaw the internet

because we couldn't

control it, but it was already a global thing. So Bill Clinton said, "Look, we're going to keep

an eye on this,

but

in the meantime, we're not going to do any taxes on e-commerce transactions."

That really helped companies like Amazon, boom, and the internet itself, boom, after that. It's

probably the best

thing Bill Clinton did as president. I think a similar thing will happen here where we will stop

doing capital

gains

taxes on Bitcoin transactions lower than $200 so you can start using Bitcoin as a currency.

Hopefully they will

say

they want to regulate the use of crypto and crimes and they'll build a crypto crime agency or

whatever, and

that's a

good thing for crypto. It means that it's being acknowledged like a real currency. It's being

regulated like the

dollar is heavily regulated, and that's the best the US could do.

If the US bans it, it doesn't mean anything. It's still going to be used. It's still going to be

used in the US

because most of the exchanges, other than Coinbase and a few others, are decentralized all over

the world. You

can't

control the flood of crypto that's out there. By the way, a very important use of crypto is

let's say you're a

protestor right now in Russia or in China. How do you get money to support your cause.

So right now in Russia or in China, how do you get money to support your cause? Well, I was

recently at a big

human

rights conference, organized in part by Gary Kasparov, who's a former world chess champion now

turned human

rights

activist. And maybe half the discussions were about how Bitcoin can better be used to fund

social activists in

these

authoritarian countries. So the US doesn't want to put a stop to that. That's how they're going

to be able to

fund

US supporters in these foreign countries. And who's the biggest user of the dark web on the

internet? The United

States. It's how we get things to people in places that are hard to get to. So there's not going

to be anything

severe, but this is causing a weight on crypto right now until Biden really announces what his

plans are, but

this

is not going to be a cause of concern in the long run.

Addison:

Yeah. Another weight on cryptos is the volatility. So Bitcoin's up, Bitcoin's down. There's

even commercials

on Comedy Central that I watch, because I think it's funny, and they're like, "Hey, you're a

Bitcoin millionaire

or billionaire. You're a billionaire. Oh no, now you're broke. Now you're a billionaire. Now

you're

broke."

James:

Yeah.

Addison:

So the volatility is an issue too. And I think people that are paying attention to us right

now, they're

skeptical of the volatility.

James:

And to be honest, I'm skeptical of it as well. I'm skeptical, to be honest, of Bitcoin. I like

Ethereum, because

Ethereum is not really used so much as a currency. Ethereum is used almost like a software language

of the crypto

ecosystem. So using Ethereum, you could make a decentralized finance exchange like we talked about

earlier, or using

Ethereum or Solana or whatever, you could make NFTs, which is not just about digital art, but it has

many real world

use cases. I mentioned one earlier, which is for ticketing, but there's many types of real world use

cases of NFTs.

So I think currency is just one application of crypto. And yeah, it's really volatile. So I don't

know, I do have a

substantial portion of my portfolio in crypto, but it's volatile. I probably have too much in it.

And I probably

wouldn't use it as a currency, but I would use it for these other real world use cases right now,

which is why I

don't mind there being a crypto dollar. I would use a crypto dollar.

Addison:

So how would you recommend people use it? Just explain how you use it, the approach that

you're using,

because I really do think that there's a lot of people who are intrigued and they want to get

involved and

they're interested, but then they're like, "Oh," whatever. They got one foot in the dollar camp

and they're

trying to understand how you translate from the banking system that they grew up with to

understanding how you

manage your money in a crypto world. I think that's a real concern for a lot of people.

James:

Well, okay, let's just use a simple example. First off, you could buy crypto the way you would buy

stocks.

Addison:

An option?

James:

Or an option, or the way you would buy dollars. You could buy a savings bond and put your money

in there and get

2%

interest. Well, I could buy Ethereum at Coinbase, which is a US centralized exchange. You could

buy Ethereum.

And

then I could say, "Hey, Coinbase, I'm going to do what's called staking my Ethereum. You could

hold it for six

months. I won't touch it. And I want 5% interest a year." That's like when you put dollars in a

savings bond.

"Hey,

Chase Bank, you could hold my dollars. I'm going to stake my dollars for a year. And then I want

2%." Well, with

Ethereum, you get 7%, and with dollars you get one half of a percent. So I could do a similar

thing in the

crypto

world that I could do with a bank.

There's also a platform set up where I could borrow against my Ethereum or Bitcoin or whatever.

Once I'm in the

system like that, I could buy other cryptos. I could use Bitcoin to buy other cryptos. Now, why

would you buy

other

cryptos? Well, again, back in 2018, you'd buy something if it seemed like a good idea, but there

were no users,

but

now there are users. So what if I could buy crypto, I could use Bitcoin to buy some of the

currency like Terra

LUNA,

which I mentioned before, which powers essentially a cryptocurrency exchange.

Well, I might do that because I think about the fundamentals of that other currency, like I might

think the

fundamentals of McDonald's are good, I might think the fundamentals of a particular crypto are

good. It's not

just a

good idea anymore. There are actual users and use cases and profits. So you could start to

really value these

other

currencies. You couldn't do that a few years ago. Now we're at the beginning of being able to do

that. And you

buy

things because you think, as an investment, it might be interesting. So Ethereum is plagued by

two problems. One

is

that it's slow. The other is there are high fees. Oh, there's a third problem, which is that the

amount of

Ethereum

that could be issued is unlimited, but Ethereum introduced some changes in the past few years

that are going

into

full effect this year, which is going to reduce the number of Ethereum in supply, and at the

same time, speed up

the

scalability of the number of transactions that could happen per second and lower fees at the

same time.

So already there was a lot of demand for Ethereum with its current supply, because that's why

Ethereum price has

gone

up over the past year or two years, but now demand is going to go up because it's going to be

better, it's going

to

be faster and cheaper, but supply is going to go down, because there's going to be this thing

called burning.

Ethereum is going to burn some Ethereum tokens after every transaction. So supply's going to go

down, demand's

going

to go up. So for me, I don't use Ethereum for anything, but I might buy it because I see other

people using it,

so I

can look at the fundamentals and I could also say, "Oh, well supply is going down, but demand's

going up," so

price

will go up. So that's kind of getting closer and closer to the characteristics of why I would

buy a stock. It's

exactly why I would buy a stock, for instance. So it's not as speculative as it once was.

Addison:

Yeah, just explain burning a little bit. It's like retiring that coin, right?

James:

Yeah. So it's a little complicated, but essentially, in any cryptocurrency like Bitcoin, every

transaction has to

be

validated. So if I send some Bitcoin to you, the transaction hasn't happened until a validator

validates it. So

somebody might be validating it because they get paid in Bitcoin to validate our transaction.

Their computer is

running all day. That's why they say Bitcoin has huge energy usage. Their computers are running

all day and they

solve these complicated math problems associated with R2 wallets, and they validate our

transaction. And as a

reward, they get Bitcoin. That's what mining is called.

Now, Ethereum is moving to something called proof of stake, where they have to stake their own

Ethereum in order

to

validate our transactions, but it happens much faster because they don't have to calculate

anything. Now, if

they do

a bad job validating though, they have to burn, they have to lose, and that's actually called

slashing. They

have to

lose, they have to give up some of their Ethereum, but after every transaction also, they have

to burn a small

piece

of that transaction. And since burning has started to be rolled out, there's actually fewer

Ethereum tokens out

there than in the beginning of this process. So that's another reason why prices in general have

gone up over

the

past year, but that's going to escalate much faster over the following year and year after that.

Addison:

Yeah, it's kind of like a free market solution to limiting the number of coins. Because the

way Bitcoin is,

in the end there's going to be 21 million of them, right?

James:

Yeah.

Addison:

But this is a free market version of that. If it's not useful anymore, then it gets burned or

it gets

slashed.

James:

Yeah. And also, the reason why nobody limited Ethereum is there's so many projects now using Ethereum

and you need

tokens to power these projects. So it didn't make sense to limit the number of Ethereum tokens, but

the more popular

Ethereum is, the more popular these platforms are that are being built on top of Ethereum, the more

tokens will get

burned, reducing supply, but then the more demand will go up and more demand, there'll be more

projects created so

more tokens will be issued. So it's, again, this market economy, but as long as there's more and

more use cases,

expect more demand, more tokens, but then also supply going down, more tokens burned. And it's not

just Ethereum.

There's a lot of proof of stake projects out there. It seems like I'm overly recommending Ethereum,

but I actually

like a lot of tokens that are being used in real world use cases. And again, there were zero of

those in 2018, 2017,

but now there's billions of dollars worth.

Addison:

Yeah.

James:

And very excited to be a part of the space.

Addison:

And actually, we could dive into that, because we just released the Big Book of Crypto in

which you talk

about many more cases rather than Ethereum. Ethereum is one, Bitcoin is another, but it's kind

of the way I've

been writing about it, it's Life After Bitcoin.

James:

Yes.

Addison:

There are many applications. Maybe you could just dive into a few of those.

James:

Yeah. And first I'll make a comparison to something that's been around for 20 or 30 years. Do you

remember, or it

still exists, the SETI, the Search for ExtraTerrestrial Intelligence? So the way SETI works is

that people all

over

the world volunteer. Basically there's huge photographs taken every second or minute of all the

stars and

galaxies

and everything. Not photographs, but I guess whatever it is you need to do to hear if there's a

signal coming

from

any part of the universe. And it's too much work for one computer to process, so people

volunteer their

computers to

help. It's this gigantic parallel processing idea to search for signals from all over space. So

hundreds of

thousands of people volunteer their computers to help out with SETI. That's the analogy.

So there's a token RNDR. Just got listed on Coinbase, actually. We recommended it before it got

listed on

Coinbase.

There's a token called RNDR, which with the rise in virtual reality and metaverses, 3D

processing is a very

complicated thing to process mathematically. To build 3D graphics, when you even turn around in

a virtual

reality,

there's tens of millions of mathematical computations that have to happen in order for you to

always see the

right

thing. And computers can't handle it. It's an exponential problem. But with RNDR, anybody who

has RNDR tokens on

their machine can do mining of more RNDR tokens by allowing companies or people to render 3D

graphics using the

tiny

pieces on their machine that the entire world will be contributing to rendering 3D graphic

computations.

So this is a real world use case that's necessary. It solves a serious problem. And guess what?

They have deals

with

Disney and Sony. So these are not just ideas. There's actually businesses behind them. I don't

know how many

users

there yet are on RNDR, but I do know they are doing real world business ideas, because they

solve important

problems

that these companies have and can't currently solve. So that's another real world use case.

Addison:

And when you were putting together the Big Book of Crypto, it sounds like you spent a lot of

time looking at

things beyond what we generally publish even in Agora, but also in the mainstream media. You've

gone beyond what

the general public can even understand, because it's not available unless you do the mining

yourself, mining of

data.

James:

No, I mean the feedback we've got, it's been amazing, because they always say write the book you want

to read.

Addison:

No, no, that's part of what I'm saying, is when I talked to you about this, you've always

gone a little bit

further than just the project at hand. You really get involved and dig in to even more of a

theoretical level of

where it could go beyond what we're currently using.

James:

Yeah. And you're right. It's not easy to get this information, because we're still at that point.

Addison:

Yeah, that's what I feel like too.

James:

Like where ... in the beginning of the internet or the beginning of the web. Let's say 1991,

1992, everyone was

really resentful that there was one day when AOL decided they were going to let all of their

users use the

internet

message groups instead of just AOL message groups. And everyone was all upset. We were all

really nerdy and

upset,

like, "Don't let those scumbags from AOL onto our internet." And the crypto world is still like

that. And I feel

like they kind of hide the information because they're so smart and genius or whatever. But

regular people don't

own

crypto yet. We're still a ways from that, even though the use cases are here and are being used

by crypto users.

So

I think a book like the Big Book of Crypto kind of helps bridge that gap. I

basically

researched,

again, I'll use an example of the internet. In 1995, I pitched a book to a publisher called Your

Second Book of

the

Internet. I felt like everybody knew what the internet was, everybody had their first book, but

I called this

one

The Second Book of the Internet. Because I wanted to explain some of the more sophisticated

ideas, but it

wouldn't

get published because everybody was like, "Oh, this internet thing's a fad." And so now though,

I got a chance

to

finally do this in the next big digital revolution, which is what's happening now with crypto.

These real world

use

cases are not going away. Here's an idea, and no one's done this yet. Let's say you graduate,

you're 22 years

old,

and you have $200,000 in student loan debt, which is not unusual.

And how are you going to get rid of that debt? Well, what if I can make a coin, like JamesCoin,

I'm 22 years old,

I

could make a coin that represents 10% of my next 10 years of future income. So all my income

will go into a

black

box, and then 10% of it will be issued out, pro rata, to the owners of this coin. So people

could basically

invest

in me. And let's say then they see, "Oh, he just got a promotion," so the value of the JamesCoin

could go up,

and

maybe James gets a royalty on that, maybe not. And maybe it gets traded on an exchange. But

there's going to be

new

asset classes created with these types of entrepreneurial ideas. The beginnings of

entrepreneurship in crypto

haven't even begun yet, other than just the investing back and forth that's going on.

Addison:

For an idea like that, crypto is disruptive by nature of the monetary system. But like what

you're describing

right there would be disruptive of the way that people pay for college.

James:

Yeah.

Addison:

The tuition rates that people pay, and also the way that the student loan system is set up to

suck people dry

for years after they get out of college. So it's a good idea because it literally, with one

coin, could spur a

smart-thinking person who wants to finance their own education. It could obviate that problem in

one

transaction, which would be great. This kind of gets to the heart of what I'm saying, or what

I'm trying to ask,

is when introducing new ideas about how crypto or blockchain can change industries, there's an

obvious

resistance to that.

James:

Yeah, I don't know.

Addison:

That exists either way.

James:

Yes.

Addison:

I mean, that's sort of the revolutionary idea of it.

James:

Yeah.

Addison:

You're kind of headlong into it, and I appreciate that, but then there's other people that

are like, "Wait a

minute, this is what I know and this is what I stick with it.

James:

Yeah, no, I agree, but look, it's going to take time. The car maker Alfa Romeo just announced

they're going to

use

NFTs to keep track of the supply chain of all their products, so they know where all the parts

of a car, so they

know where each part comes from, and I don't even know what they're going to use it for, but

they've announced

this.

So clearly some mainstream industries are starting to use it. And again, I always try to be as

skeptical as

possible. I never want to be religious about investing because that's how you could go broke,

which I've done

several times before. So I'm used to being religious. And I'm always skeptical.

So for me, I've told myself over and over again, "2022, I need to see real world use cases. Not

just people using

crypto to buy more crypto on a crypto exchange." That was fine in 2021 because we needed to see

money, we needed

to

see users, and we needed to see people trust the ecosystem. But now I do think we need to see

people not just

playing around with crypto, but really using it to improve their businesses or improve their

lives, like in the

examples I've given. I want to see people making 3D virtual worlds using this render token for

instance. Or there's FileCoin, which is like the crypto of Dropboxes. I want to

see people

storing

real files, not just crypto files, on a network like FileCoin. Things like this I need to see or

I will be

skeptical

again.

Addison:

So I have a real world example for you that I haven't pulled the trigger on, but I have a

piece of land in

Nicaragua that's associated with the Rancho Santana Project that Agora put together, and

somebody offered me a

bunch of Bitcoin for it. And I'm like, I was watching the price of Bitcoin drop like 20% in the

period of time

that I was talking about it. And so I'm like, "Okay, do I want the real property? Which has

political risk,

there were people fighting in the streets in Managua, and people are scared to go to Nicaragua?

Or do I evaluate

the market risk of the volatility of Bitcoin?

James:

Or a third choice is you could turn the Bitcoin immediately into dollars.

Addison:

Yeah, I didn't want to do that either, because I don't really want to hold dollars. I guess I

could trade it

for gold too. I could trade it into dollars. I could take Bitcoin, put it in dollars, and buy

gold. I could do

all of those things, but what I ended up with was the land to me is worth more on an intrinsic

value than any of

the other three.

James:

Well, again, I'm invested in a lot of different coins. I've actually sold all my Bitcoin, but I

have a lot of

Ethereum and I have some other coins. I personally like where Ethereum's at, this is just us

talking about

what's a

good investment and what's not. Personally, if anybody offered me Ethereum for anything, I would

take it,

because I

think Kathy Wood from Arc has predicted, $180,000 price for Ethereum by 2030. That seems high,

but even the

Winklevoss brothers have predicted a million dollar Bitcoin in the next few years. And they give

really strong

arguments, they're not just looking at the charts, they're giving really strong arguments.

Ethereum, because of the dynamics I explained earlier about what's happening this year and the

changes of proof

of

work to proof of stake, that could easily see 10 or 20,000 this year. I think it's going to be

decoupled

ultimately

from Bitcoin though. These things are going to have value on their own, just like McDonald's,

sometimes in a

period

like this where there's so much uncertainty, McDonald's stock, Exxon stock, and Microsoft stock

all go up and

down

together, whether people are panicking or not. But eventually the market settles down and

Microsoft goes up,

McDonald's stays the same, Exxon might go down if oil starts to go down. So eventually they get

decoupled. And I

think eventually Bitcoin and Ethereum and other coins get decoupled from each other and then you

just have to

decide

which ones you think have the best fundamentals. But like you said, the land in Nicaragua could

be risky too, or

it

could be a boom. If things stabilize there, people start moving there and retiring there, and

that's a boom.

Addison:

Yeah. All right James, it's always good to catch up with you. We started this conversation

about Bitcoin and

crypto currencies during wartime, but it's really just a discussion of how to approach it. It's

really a new

asset class, that's the way I look at it.

James:

It's a new asset class and it's going to create other new asset classes, which is what's exciting to

me. That's what

I'm really waiting for. I'm tired of crypto as an asset class, I want crypto to create new asset

classes.

Addison:

Yeah.

James:

Which is really exciting.

Addison:

And that's what you write about in the Big Book of Crypto. I mean, that's what it's all

about,

right?

James:

Yeah.

Addison:

All right, so we're going to recommend people get a copy of that, and you also have a trading

service where

you make recommendations on the cryptos that you do like.

James:

Oh yeah, today we recommended something in the Metaverse space, which also by the way, I'm a little

skeptical of

Metaverse so that's why we have a unique twist on our recommendation today. I want to just see

people using these

things. I have kids, they have fun playing video games, so I want to see them using the Metaverse

and having fun. I

don't want people just buying and flipping land because they read an article that you can get rich

in the Metaverse.

That's bullshit to me. I like to see users, real users, then you can judge the fundamentals of

whether it's good or

bad.

Addison:

All right, so tell me a little bit about the trading service itself, just so that if

somebody's interested

after hearing us talk they can get a little bit more involved in the trades that you're

recommending.

James:

Yeah, we spend a lot of time talking to everybody in the space, whether it's crypto hedge fund

managers, or the

programmers in charge of crypto products, or the users of different crypto projects. We gather a

lot of

information

and then we try to pick tokens that have good fundamentals, so regardless of anything else, the

number of

transactions on them will continue to improve. The number of users will improve, the real world

will benefit,

and so

on. And we do a little twist on that, we try to find, at least right now, this strategy could

change down the

road,

we try to find tokens that don't yet trade on Coinbase, but for various reasons we think will

trade soon on

Coinbase. Because once you're on Coinbase, that's another 76 million users who could potentially

buy your

crypto. So

we try to recommend some cryptos right before they go on Coinbase, it's kind of a catalyst for

them to go up.

But

they always have good fundamentals, real users, that's very important to me. No BS tokens, no

fad tokens.

Once again, like anything, 90%, 95% of businesses fail, so 95% of tokens are not going to work

out. We want to

avoid

those, and you do that by finding real world use cases.

Addison:

This will be the last question just because I think we're beating a dead horse at this point.

But what do you

make of the Super Bowl weeks? The game only lasts whatever, two hours, or three hours, but the

advertisements

for Coinbase, FTX, and the other crypto trading platforms were just ubiquitous on mainstream TV

for a couple

weeks. And they're trying to get people to sign up. Historically to me, that would be a sign of

the top of a

bubble, where it's getting into the mainstream media and there's a lot of people that don't know

what they're

doing getting involved. And maybe that's good if you're a trader and you can read the tea leaves

and make sure

that you're on the right side of the trade. But at the same time it makes me skeptical that

there's a lot of

people who are getting into trading that may or may not be a good idea for them to be

there.

James:

Yeah, I thought two things, and the first was what you're saying, like this reminded me a little of,

"Oh my gosh,

this is like Pets.com in 2001."

Addison:

Yeah.

James:

Or 2000 rather. And Pets.com does a Super Bowl ad and then it's like the day after that they go out

of business.

Addison:

Yeah.

James:

But history doesn't repeat, it rhymes. It's always the irony that everyone expects one thing and

then the

opposite

happens, particularly in markets. So we'll see. But what was also very interesting to me, and

this is related to

your other point about will too many people be speculating? They mentioned Coinbase on the Super

Bowl.

Coinbase's

site crashed minutes later. Now, Coinbase has 76 million users, they can handle a large amount

of traffic. So

the

traffic that was going to Coinbase must have been so enormous within seconds of that ad, and

that tells me that

nobody is really invested in crypto yet. They say 10% of the US. I don't believe that, it's

probably more like

1/10

of 1% of the US has cryptocurrency of some sort. And so people are desperate to find out about

this stuff and

invest

because it's real, or at least they suspect it's going to be real.

And so, yes, when E-Trade made internet stock speculation widespread in the late 90s, that

created kind of a

bubble.

But Bitcoin's been through its bubble phase as well, so I don't know. I think it'll be a good

thing when more

people

have access to an asset class that everybody says, "Let's have less wealth inequality." Well,

some people are

getting rich on crypto and others aren't, because quite frankly it's complicated to buy crypto

in most cases.

And I

think Coinbase is doing the best job to make it simple, but it needs to be even simpler. But

people are eager to

get

involved in it, and I think you will see a lot more speculation but also a lot more long-term

investing, because

there's real fundamentals there, which didn't exist on the internet for the first 10 years of

the web, or 15

years

of the web.

Addison:

Yeah. All right James, thank you sir.

James:

Thank you so much Addison, as always.